Nepal’s rug industry has long been a significant economic driver, known for its hand-knotted woolen carpets that have gained international recognition. However, in recent years, it has faced a 65% decline in exports due to various structural challenges. This report presents key data and trends shaping the Nepalese rug industry today.

Market Overview & Growth Trends

Key Statistics:

| Peak Export (1993/94): 3.33 million sq. meters | |

| Current Export (2025 Estimate): 600,000 – 700,000 sq. meters (⬇ 65%) | |

| Annual Revenue: Rs. 600 crore from rug exports | |

| International Share: 90% of Nepalese rugs are exported | |

| Production Units: 600+ small-scale carpet manufacturer |

Key Observations:

✔️ Initial boom due to lower costs, exclusive designs, and GSP tax exemptions

✔️ 1990s market saturation & competition from India and China led to decline

✔️ Rising demand for organic, natural-dye, and sustainable carpets in niche markets

Source: Nepal’s Carpet Globalization (2003) [PDF]; Industrialization Strategy for Nepalese Carpet Industry (2025) [PDF]

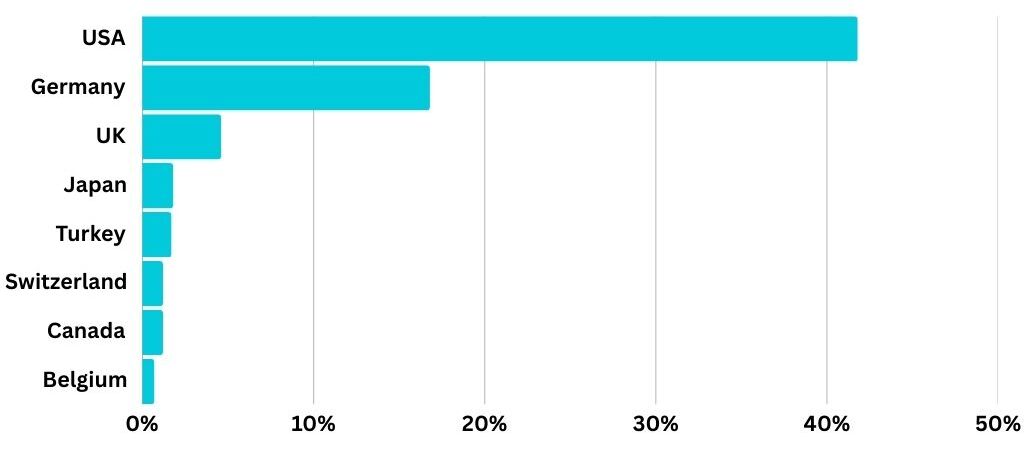

Key Export Markets & Revenue Data

Top Importing Countries & Export Figures (2025):

Source: Industrialization Strategy for Nepalese Carpet Industry (2025) [PDF]

Export Logistics & Supply Chain:

Air Freight (75% of exports) – via Tribhuvan International Airport

Land Route – Birgunj to Kolkata port for global shipment

Trade Preferences: Nepal benefits from GSP tax exemptions in major markets

Source: Hand Knotted Woolen Carpets Manufacturing [PDF]

Production Process & Labor Force

Workforce & Employment:

Source: Hand Knotted Woolen Carpets Manufacturing [PDF]

Materials & Methods:

- Traditional hand-knotted wool rugs dominate the industry

- New materials gaining traction: Hemp, Allo, Jute

- Shift to natural dyeing techniques as synthetic dyes fall out of favor

Challenges & Opportunities

Structural Challenges (Backed by Reports):

Export Decline: From 3.33M sqm (1993) → 0.7M sqm (2025) due to high global competition

Raw Material Dependency: 80% of wool is imported, making production costlier than India/China

Labor Costs vs. Productivity: Nepalese rugs cost 30-40% more to produce than Indian counterparts

Compliance & Regulations: Increased certification requirements (RugMark, Fair Trade) adding costs

Quality Issues: Lack of dye standardization leading to rejections in EU markets

High-Impact Growth Areas:

Eco-Friendly Carpet Boom: Demand for organic & naturally dyed rugs growing in EU/US markets

Handmade Certification Advantage: Nepalese rugs now qualify for “Handmade Label” in Europe

Luxury Market Positioning: Direct-to-consumer (DTC) brands charging premium rates

Export Diversification: Focus shifting towards Turkey, UAE & Japan to reduce EU dependency

Government SEZs (2025-2030): Plans to establish dedicated carpet production zones

Future Projections (2025-2030)

Projected Export Growth: 10-15% annually if local wool production increases

Sustainable Material Shift: 35% of rugs expected to be eco-certified by 2030

Automation in Weaving: Introduction of semi-mechanical knotting to enhance productivity

Rural Relocation Strategy: Expected 20% cost reduction by shifting production outside Kathmandu

Conclusion & Policy Recommendations

To revitalize Nepal’s rug industry, immediate policy interventions are required:

- Subsidized Wool Farming: Cutting import reliance (80%) can reduce costs drastically

- Dye Standardization Program: Ensuring uniform quality for exports, reducing EU rejections

- Luxury Market Penetration: Positioning Nepalese carpets as handmade luxury via branding

- Infrastructure Boost: SEZs to reduce production & compliance costs

Infographic Summary:

🟢 Exports down from 3.3M sqm (1993) → 0.7M sqm (2025)

🟢 100,000+ artisans, 300,000+ indirect jobs

🟢 80% wool imported → Major cost driver

🟢 EU/US luxury segment prefers “Handmade Label”

🟢 SEZs & local wool can cut costs by 20%

🟢 Projected 10-15% growth with reforms

📌 Strategic focus: Local production, niche branding & cost efficiency!